Monatlicher Rückblick – McDonald’s E.-coli-Krise, Hersheys Automatisierungsinitiative und BMWs Fortschritte in der Digitalfabrik

Yulia Fedorova

04 Nov 2024

Die aktuelle McKinsey-Global Supply Chain Leader Survey unterstreicht, dass Lieferkettenprobleme auch 2024 weit verbreitet bleiben – 90 % der Befragten berichten über erhebliche Herausforderungen. Die Ergebnisse zeigen, dass Unternehmen möglicherweise weniger in Resilienz investieren, obwohl Schwachstellen bestehen bleiben. Auffällig ist, dass viele Firmen nicht ausreichend darauf vorbereitet sind, Risiken effektiv zu erkennen oder zu mindern, und dass Diskussionen auf Vorstandsebene weiterhin begrenzt sind. Nur ein Viertel der Unternehmen verfügt über formelle Prozesse zur Besprechung von Lieferkettenrisiken im Top-Management – ein Umstand, der Organisationen anfälliger für künftige Störungen machen könnte, wenn er nicht adressiert wird.

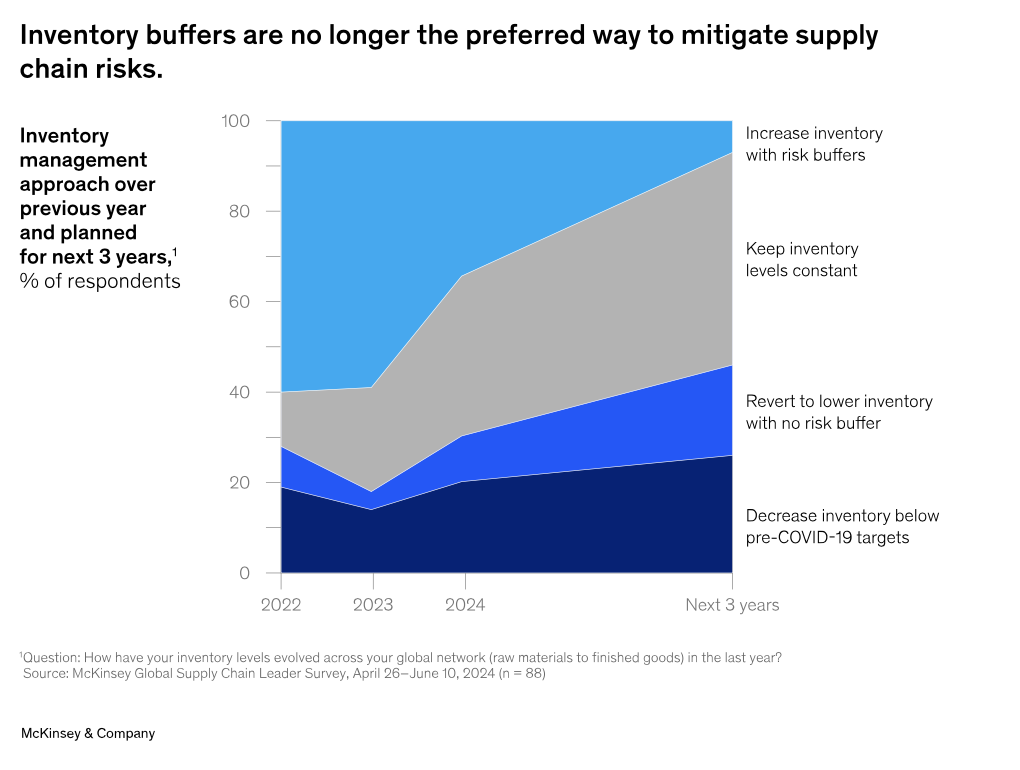

Ein zentrales Thema ist die Bestandsstrategie. Die Umfrage zeigt, dass Unternehmen in ihrem Ansatz zur Bestandsführung gespalten sind. Fast die Hälfte plant, die Bestände beizubehalten, teilweise mit Anpassungen im Sortiment oder in der Verteilung über die Netzwerke. Im Gegensatz dazu erwarten rund 46 %, Risikopuffer zu verringern oder zu entfernen, um die Bestände näher an das Vor-Pandemie-Niveau oder sogar darunter zu bringen. Nur ein kleiner Teil – 7 % – plant, die Bestände zu erhöhen, was darauf hindeutet, dass große Sicherheitsbestände weiterhin unattraktiv als langfristige Risikomanagementstrategie gelten. Diese Uneinigkeit zeigt, wie unterschiedlich Unternehmen versuchen, Resilienz und Kosteneffizienz auszubalancieren – und ob hohe Bestände als Schutz dienen oder schlanke Modelle zur Kostenreduzierung bevorzugt werden.

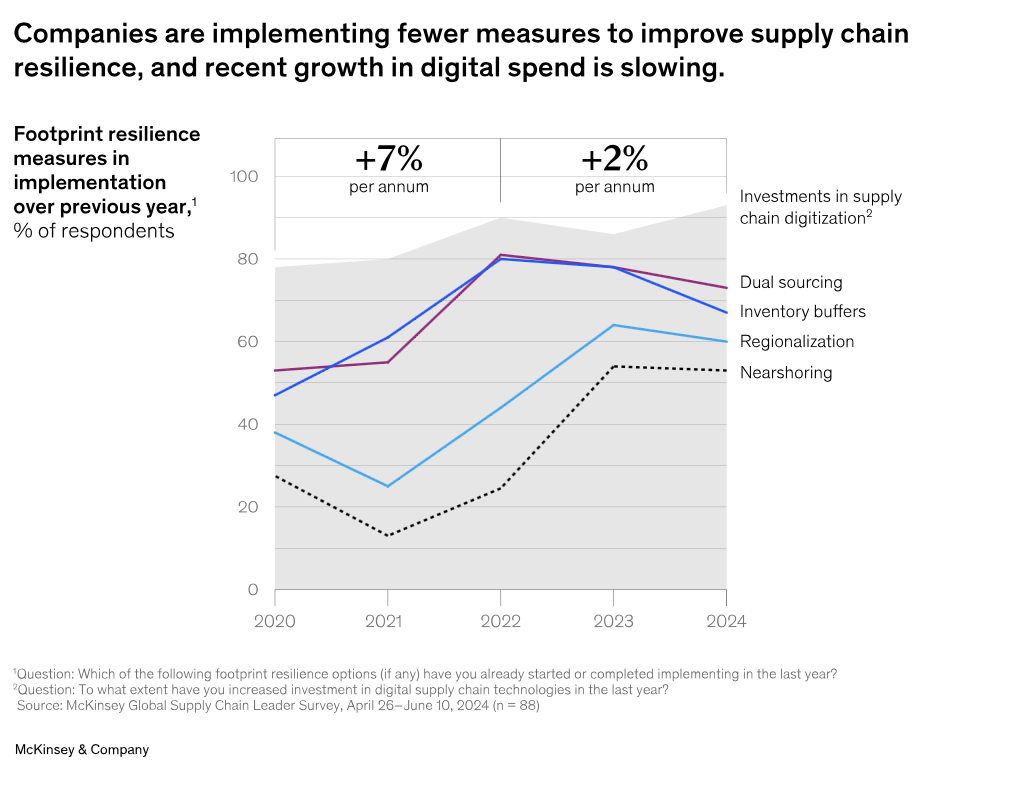

Der Fortschritt bei zentralen Resilienzstrategien wie Dual Sourcing, Regionalisierung und Nearshoring scheint in den letzten zwei Jahren ins Stocken geraten zu sein. Obwohl diese Ansätze nachweislich zur Stärkung der Lieferketten beitragen, verfolgen immer weniger Unternehmen sie aktiv. Auch die Digitalisierung – insbesondere im Bereich Advanced Planning and Scheduling (APS) – hat sich nach einem starken Wachstum von 2020 bis 2023 verlangsamt. Obwohl zwei Drittel der Unternehmen in APS investieren, haben nur 10 % die Implementierung abgeschlossen, was auf mögliche Herausforderungen bei der Einführung hindeutet. Zudem haben ein Drittel der Befragten keinen klaren Business Case, und 15 % berichten, dass APS-Initiativen die Unternehmensziele nicht erreicht haben. Diese Zahlen deuten darauf hin, dass Unternehmen das Potenzial von APS für Prognosen, schnelle Reaktionen und Szenarioplanung noch nicht vollständig ausschöpfen.

McDonald's arbeitet mit Hochdruck an der Bewältigung eines E.-coli-Ausbruchs, der mit seinen Quarter-Pounder-Burgern in Verbindung steht, indem es insbesondere die Lieferkette untersucht, darunter die Herkunft von Zwiebeln und Rindfleischpatties. Gemeinsam mit den CDC prüft das Unternehmen seine Zulieferer im Raum Chicago, um herauszufinden, wie die Kontamination entstanden sein könnte. Erste Erkenntnisse des USDA deuten darauf hin, dass Zwiebeln die wahrscheinliche Ursache sind, während Tests an Rindfleischproben noch laufen. McDonald's hat historisch sehr strenge Sicherheitsstandards in seiner Lieferkette etabliert und über Jahrzehnte größere Lebensmittelsicherheitsprobleme vermieden. Der Vorfall wirft jedoch ernsthafte Fragen zu Schwachstellen in der Lieferkette auf, insbesondere da E.-coli-Ausbrüche zunehmend auf Gemüse zurückgeführt werden, das durch nahegelegene Viehzuchtbetriebe kontaminiert wurde. Obwohl McDonald's-Zulieferer regelmäßige Tests durchführen, blieb der für diesen Ausbruch verantwortliche Stamm unentdeckt – ein Hinweis auf mögliche Lücken in der Qualitätskontrolle. Der Vorfall gefährdet McDonald’s Ruf und könnte sich negativ auf die Einnahmen auswirken. Experten betonen, dass eine schnelle Identifizierung und Entfernung kontaminierter Produkte entscheidend ist, um weiteren Schaden zu verhindern. Der Fall verdeutlicht zudem die Komplexität und Risiken bei der Steuerung globaler Lebensmittellieferketten großer Fast-Food-Konzerne.

Hershey investiert 250 Millionen Dollar in seine Initiative "Advancing Agility and Automation", um bis 2026 Agilität, Transparenz und Effizienz in der Lieferkette zu steigern. Die Initiative integriert Technologie und Automatisierung in Beschaffung, Produktion und Planung – als Erweiterung einer früheren Investition von 1 Milliarde Dollar in die Lieferkette. Durch die Nutzung von SAP S/4 will Hershey Prozesse vereinheitlichen, kürzlich übernommene Marken integrieren und eine bessere Bestandstransparenz schaffen, was eine genauere Abstimmung von Angebot und Nachfrage ermöglicht. Das Programm, unterstützt vom neuen CTO Deepak Bhatia, soll jährlich 300 Millionen Dollar einsparen – durch weniger Ausschuss, optimierte Bestände und schnellere Innovationszyklen.

Das BMW-Werk Regensburg treibt im Rahmen der BMW-iFACTORY-Initiative den Aufbau eines vollständig digitalen und automatisierten Logistiksystems voran – mit dem Ziel einer „Digital Factory of the Future“. Das Werk produziert alle 57 Sekunden ein einzigartiges Fahrzeug und versendet täglich bis zu 1.400 BMW X1 und X2, darunter Verbrenner, Hybride und Elektrofahrzeuge – individuell nach Kundenwunsch. Die Steuerung der komplexen Logistik erfolgt über cloudbasierte, automatisierte Systeme wie die BMW Automated Transport Services (ATS), die fahrerlose Transportsysteme koordinieren. Die Flotte umfasst fast 50 automatisierte Routenzüge und über 140 Smart Transport Robots, die jeweils bis zu eine Tonne Teile transportieren können. Diese Systeme optimieren Materialfluss und rechtzeitige Anlieferung, um Produktionsunterbrechungen zu vermeiden. BMW erweitert die autonome Flotte aktuell um neue Fahrzeugtypen wie Hubwagen und Gabelstapler, um ein nahtlos integriertes logistisches Netzwerk aufzubauen, das effiziente und flexible Fahrzeugmontage ermöglicht.

Mehr aktuelle Highlights

- Die deutsche Wirtschaft riskiert laut Bundesbank eine Phase der Stagnation

- Transformation der deutschen Autoindustrie könnte 186.000 Jobs kosten bis 2035

- Vermietungsmarkt für Logistikflächen in Deutschland: Warten auf bessere Zeiten

- E-Commerce: Brüssel leitet Verfahren gegen Temu ein

- Sendungen von Temu und Shein treiben deutsche Paketbranche im Weihnachtsgeschäft an

- Unilever verzeichnet beschleunigtes Umsatzwachstum unter neuem CEO

- Amazon stellt Same-Day-Lieferungen aus lokalen Läden ein

- USA untersuchen Teslas Full Self-Driving Software in 2,4 Mio. Fahrzeugen nach tödlichem Unfall

- China fordert Autohersteller auf, Expansion in Europa zu stoppen

- Arzneimittelengpässe schaffen unerwartete Chancen für die Pharmalogistik

- Europäische Airlines kämpfen in Q3 mit Flugzeugverzögerungen und hohen Kosten

- Katastrophenlogistik: 1.200 Menschen weiterhin in Fahrzeugen eingeschlossen in Valencia

Forschung im Fokus

"Towards autonomous supply chains: Definition, characteristics, conceptual framework, and autonomy levels" von Xu, L., Mak, S., Proselkov, Y. und Brintrup, A. (2024)

"Improving efficiency and sustainability via supply chain optimization through CNNs and BiLSTM" von Dalal, S., Lilhore, U.K., Simaiya, S., Radulescu, M. und Belascu, L. (2024)

"Sustainable supply chains in the heavy vehicle and equipment industry: a multiple-case study of four manufacturers" von Shekarian, E., Prashar, A., Majava, J., Khan, I.S., Ayati, S.M. und Sillanpää, I. (2023)

"Digital transformation and sustainable performance: the mediating role of triple-A supply chain capabilities" von Mohaghegh, M., Blasi, S., Russo, I. und Baldi, B. (2023)

Events

Green Aero Days

Wann: 03. – 04. Dezember 2024

Wo: Toulouse, Frankreich

Was: Die Green Aero Days bringen Flugzeughersteller, Zulieferer, Experten, Flughafenbetreiber, Energieversorger, Investoren sowie regionale, nationale und internationale Institutionen zusammen, die heute an der klimafreundlichen Leichtluftfahrt von morgen arbeiten.

The Magnetics Show

Wann: 03. – 04. Dezember 2024

Wo: Amsterdam, Niederlande

Was: Die Magnetics Show Europe ist der zentrale Treffpunkt für alle, die die dynamische und innovative Welt der magnetischen Materialien und Technologien erkunden möchten. Als Drehkreuz der Magnetikindustrie und ihrer weit verzweigten Lieferketten bietet die Messe die ideale Gelegenheit, sich zu vernetzen, neue Geschäftsmöglichkeiten zu erschließen und die neuesten Entwicklungen kennenzulernen.

FOAM EXPO

Wann: 03. – 05. Dezember 2024

Wo: Stuttgart, Deutschland

Was: Europas größte kostenfreie Fachmesse und Konferenz für technische Schaumstoffprodukte und Fertigung. Hier können Sie Ihr Netzwerk erweitern, Branchenführer treffen und modernste Technologien entlang der gesamten Lieferkette entdecken. Zudem bieten die Vorträge wertvolle Einblicke in Themen wie Nachhaltigkeit, Anwendungen, Fertigung und Lieferkettenstörungen.

Nordstil

Wann: 11. – 13. Januar 2025

Wo: Hamburg, Deutschland

Was: Als zentraler Treffpunkt des Nordens zieht die Nordstil jedes Jahr zahlreiche Einkäufer nach Hamburg. Hier treffen regionale Händler und viele weitere Branchenakteure auf innovative Produkte, die ihr Sortiment für die kommende Saison bereichern. Eine Fülle an Inspiration und eine Produktauswahl, die es so nur in Norddeutschland gibt.