Monthly Roundup - Port-Automation Pulse, EU Due-Diligence U-Turn, G7 Tax Truce & Apple’s Supply-Chain Jitters

Moritz Krol

07 Jul 2025

Summer is here — and so is a fresh wave of supply-chain story-lines

With the UEFA Women’s Euro underway in Switzerland and the Tour de France already climbing Alpine switchbacks, Europe’s summer energy is unmistakable. But while footballs are flying and break-away groups are forming, supply-chain and logistics professionals have their own drama to track — from shifting energy-security alerts to surprise regulatory rewrites.

News to watch

1. Apple’s China-centric supply chain under fresh fire

A widely read Handelsblatt essay warns that the iPhone maker “could squander its future” if it fails to tame two converging threats: Trump-era tariff pressure and a lagging AI roadmap. Analysts quoted in the piece argue Apple still assembles over 90 % of iPhones in China, leaving margins exposed if the White House follows through on mooted 25 % device tariffs; meanwhile, rivals are racing ahead on on-device AI that demands bespoke silicon and new supplier capabilities. Complementary industry reports note Apple has begun shifting premium-model production to India and earmarked US$500 bn for US facilities—but say replicating China’s dense supplier ecosystem will be a multi-year slog. In short, the Cupertino giant’s vaunted supply-chain machine suddenly looks less untouchable.

2. G7 carves out a deal on the US global-minimum-tax clash

Finance ministers from the G7 struck a late-night compromise that lets Washington’s existing 15 % corporate-minimum-tax rules count toward the OECD “Pillar Two” regime. In return, Congressional Republicans agreed to scrap Section 899 of the draft One Big Beautiful Bill, a retaliatory levy that had threatened to slap extra duties on imports from countries using the OECD framework. The move removes a major tax-planning cloud for multinationals with transatlantic supply chains and averts a summer of tit-for-tat tariffs that risked snarling ports just as peak-season shipping ramps up. European trade groups welcomed the truce as “certainty we can finally price into contracts.”

3. Germany downgrades its gas-supply alert

Just two years after Berlin sounded the “alarm” level amid the post-Ukraine energy shock, Economy Minister Katharina Reiche has eased the status back to “early warning.” Storage refill programmes are slowing, prices have settled near €34/MWh, and officials insist market mechanisms can now balance flows. The early-warning tier remains in place as a precaution, but for logistics planners the headline is clear: LNG routing and industrial energy schedules look far less fragile heading into Q4.

4. EU Council moves to soften the Corporate Sustainability Due-Diligence Directive

In a late-night compromise, member-state envoys agreed a negotiating mandate that trims supplier-level obligations, limits liability to direct tier-one partners and shifts enforcement back toward national capitals. Critics say the change shreds the original level playing-field and could splinter compliance into 27 rulebooks; businesses welcome the lighter paperwork. NGOs have already dubbed the text a “weak-chain law,” foreshadowing fierce trilogue haggling after the summer break.

5. Capitol Hill sounds the rare-earth alarm

At an Axios “Future of Defense” forum, senators and defence-industry leaders warned that U.S. dependence on Chinese rare-earths is now a front-line strategic risk. Proposals ranged from sector-specific FTAs for critical minerals to AI-driven supply-chain mapping for the Pentagon’s “replicator” drone programme. The bipartisan mood: resilience funding and friend-shoring incentives will accelerate before the 2026 budget cycle. Expect knock-on demand for EU and Australian processors.

6. “Europe could become a province of China,” says AMG Lithium boss

Speaking as his Saxony hydroxide refinery ramps up, CEO Stefan Scherer blasted Brussels for lacking bite in its Critical Raw Materials Act. Without temporary tariffs or tax breaks, he argued, green-tech supply chains will stay Chinese-dominated, jeopardising both climate targets and industrial competitiveness. The comments reignite debate over whether the EU should copy the U.S. Inflation Reduction Act’s aggressive localisation playbook.

7. Yusen Logistics rolls out FourKites’ NIC-Place visibility platform

Yusen’s European healthcare arm has deployed real-time temperature-controlled tracking across its carrier network using FourKites’ NIC-Place. The launch promises tighter lane performance, simplified GDP compliance and faster exception handling — a timely upgrade as vaccine-transport volumes climb again. Analysts see it as another proof-point that granular IoT data is moving from “nice-to-have” to table-stakes in pharma logistics.

Research radar — four studies worth bookmarking

- Stakeholders’ Attitudes toward Container-Terminal Automation: Maritime Economics & Logistics, 25 Jun 2025. Survey reveals support from carriers and governments but deep union unease; useful for social-licence risk mapping.

- “AI Meets Spend Classification”: Journal of Purchasing & Supply Management 31 (3). LLM-assisted spend cubes deliver 30% faster cycle-times and fewer human recodes.

- COVID-19’s Lingering Bullwhip: arXiv, 4 Jun 2025. Econometric evidence shows demand-signal amplification remains 42 % above pre-pandemic norms across 67 U.S. sectors.

- Generative-AI Credit Models for 3PL-Led SCF: arXiv, 18 Jun 2025. Conditional generative modelling plus DeepFM cuts default-prediction error by 18%.

Quick take-aways

- Policy breathing room … for now. Germany’s lower gas alert, the EU’s softer due-diligence draft and a G7 tax compromise all ease near-term cost pressure and tariff risk—but underline how quickly rules can pivot.

- Geography risk is back on the C-suite agenda. Apple’s China-heavy footprint shows even the world’s best-oiled supply chains can become liabilities overnight; expect renewed board-level scrutiny of regional concentration.

- Security still outranks sustainability. From rare-earth bills in Washington to raw-material warnings in Berlin, resilience investments are out-pacing green mandates in 2025 capital budgets.

- Data infrastructure decides winners. Port-automation sentiment tracking, LLM-powered spend cubes and real-time cold-chain visibility confirm that speed of insight—more than fleet size—now separates leaders from laggards.

What’s New at numi

While Europe cheered stage wins and penalty shoot-outs, our engineers were busy shipping a quartet of upgrades that make numi faster, smarter and more your own:

- Championship-grade forecasting. We’ve rolled out a new suite of algorithms fresh from the Kaggle podium, giving you accuracy levels previously reserved for data-science competitions. Expect tighter safety-stock targets and fewer unpleasant surprises on the P&L.

- A front-end built for speed. The entire UI has been re-engineered, cutting load times for multi-million-row datasets.

- Model selection that matches demand DNA. Planners can now let numi auto-suggest — or manually pick — the best algorithm for each SKU family, whether you’re dealing with intermittent MRO parts or high-turn fashion basics.

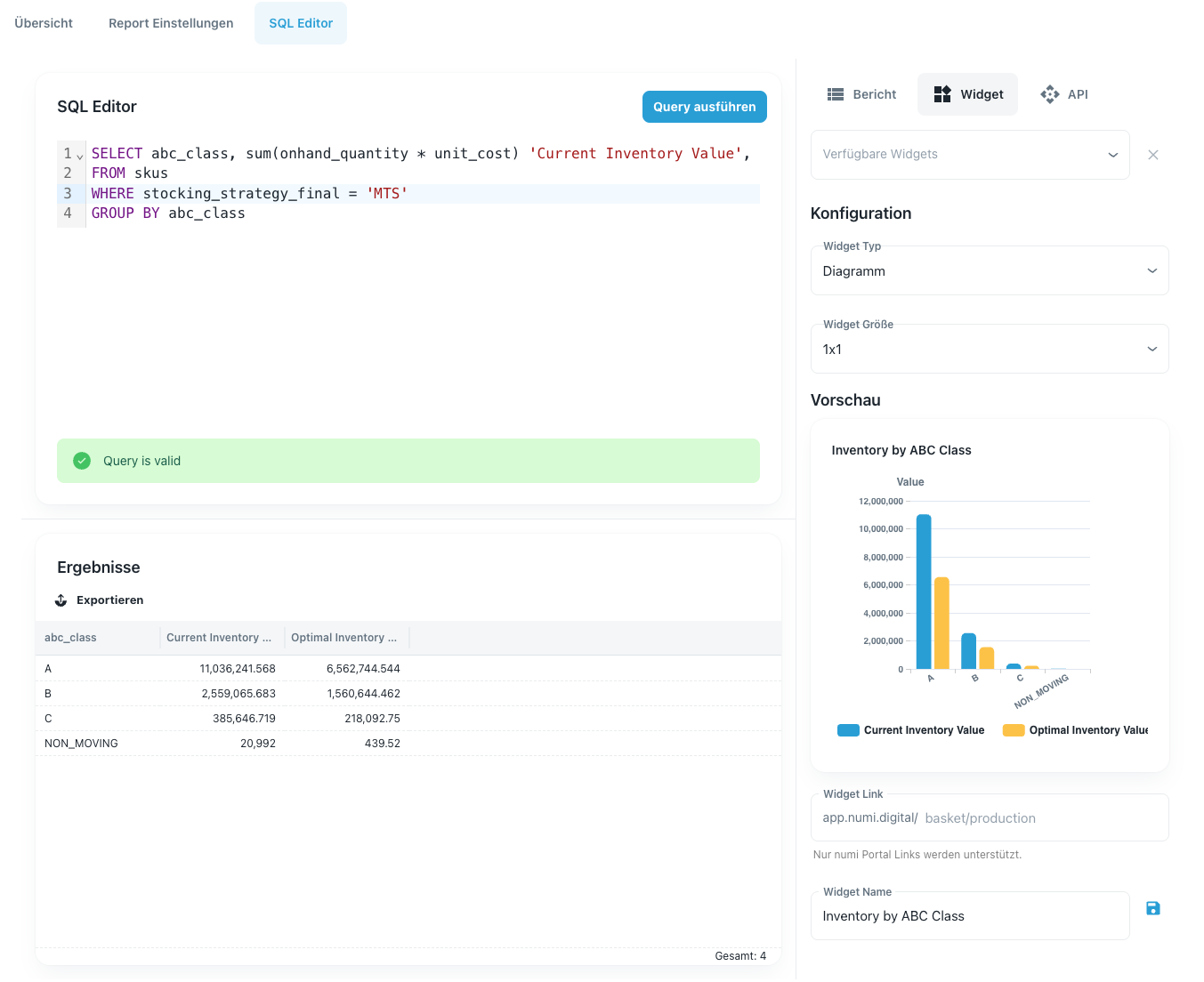

- DIY home-screen widgets. Drag-and-drop tiles now accept custom SQL-style queries, so you can craft your own charts, tables or KPI cards and pin them next to the built-ins. Your cockpit, your rules.

Together these features mean smarter forecasts, snappier workflows and a workspace that flexes with the way you think about your supply chain. Dive in and tell us what you build next!

Events

With much of Europe on its traditional summer hiatus, the trade-show calendar slips into a brief lull — look for our next round of event updates when things rev back up in August.